This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Rosslyn resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: I recently got a job in the D.C. Metro area and will be moving to the area next year. I am open to living in Northern Virginia, Washington D.C., or Maryland and want to know which jurisdiction offers the most favorable taxation.

Answer: Congratulations on your new job (Amazon HQ2?)! There must be a lot going on in your mind right now like whether you’re still young enough to offer your friends pizza and beer to help you move.

For years I’ve looked for a good resource to send clients in response to this question and couldn’t ever find it, so I reached out to my CPA, Klausner & Company located in Arlington, Virginia, who I highly recommend, to come up with a detailed yet simple chart to compare taxation between Virginia, Maryland and Washington D.C. across different incomes.

So with that, I will turn this week’s column over to Chris Light and the tax experts at Klausner & Company, enjoy!

First thing’s first, Virginia, Washington D.C. and Maryland all have reciprocity with each other. This means that if you live in one state and work in the other, you only have to worry about paying taxes and filing a tax return in the state that you live in.

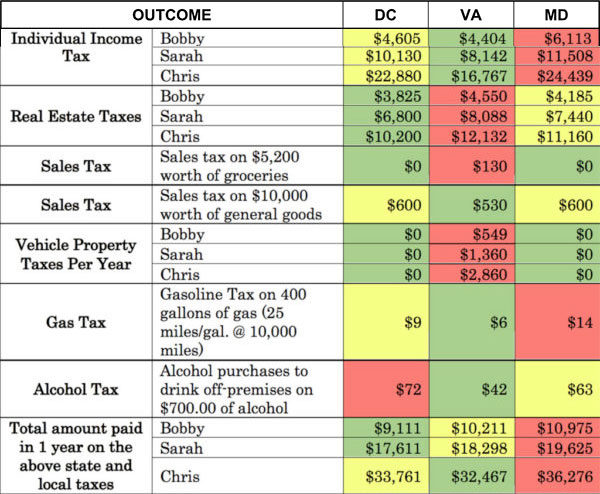

Let’s analyze the tax outlook of three different people who have just landed new jobs as employees in the D.C. Metro area:

- Bobby’s AGI is $85,000. Bobby has a vehicle valued at $18,000 and a home valued at $450,000.

- Sarah’s AGI is $150,000. Sarah has a vehicle valued at $35,000 and a home valued at $800,000.

- Chris’s AGI is $300,000. Chris has a vehicle valued at $65,000 and a home valued at $1,200,000.

Important Notes

AGI, Adjusted Gross Income, is a term to describe a person’s income minus some specific deductions. Bobby, Sarah and Chris’ AGI are all based on salary earned by the end of 2018. AGI is used to determine taxable income, as seen in the ‘Math’ chart below. Taxable income determines which income tax brackets they fall in.

They are all taking the standard deduction. Virginia and Maryland property taxes vary by county and city/town, so the table below uses Arlington County rates for Virginia and the average Montgomery County rate for Maryland. Now let’s crunch some numbers:

For the full text of this column including summary of findings, how adjustments like renting and being married impact your tax position, and helpful reference tables please follow this link (don’t worry, I won’t ask for your email address, I just don’t have enough space here).

Thank you very much Klausner & Company for finally providing people with an easy to understand breakdown of taxation in the DMV. For those of you in need of CPA services for yourself or your business, I am a loyal, happy client and I can’t recommend them enough.

They provide specialize in tax services for individuals and small business and have over 40 years of experience in the Greater Washington area.

Once you’ve taken advantage of the provided tax information and would like to talk about the non-tax related questions you have about where to live, please reach out to me at [email protected]. Our team has worked with buyers from all over the country and the world to find the right neighborhood and we’re happy to help you too.

If you’d like a question answered in my weekly column, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.