Arlington officials now look set to further loosen rules around the creation of “accessory dwelling units” sometime this spring, changing some zoning standards to allow more property owners to build the homes on their land.

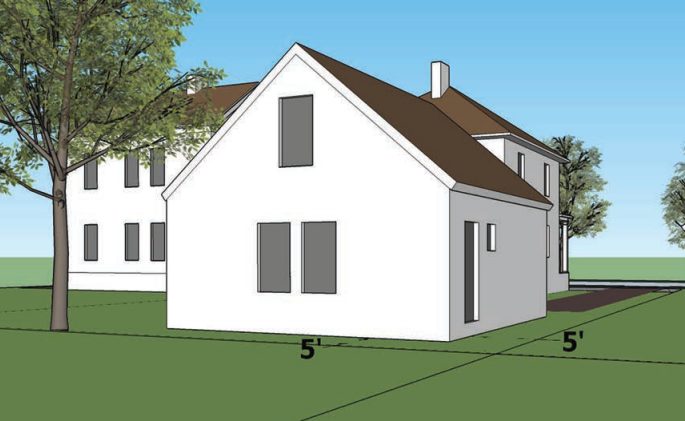

County staff are now circulating a draft policy recommending that local leaders allow property owners to build the homes, commonly known as “mother-in-law suites,” with a five-foot setback from the street and property lines.

The County Board has long sought to see more people build “ADUs” around Arlington, viewing them as low-cost way to beef up the county’s housing options. Officials have become especially interested in the homes as they’ve debated ways to improve access to “missing middle” housing, or homes that offer rent prices somewhere in between new, luxury apartments and subsidized affordable homes.

The Board worked in 2017 to loosen regulations on ADUs and expand their creation in Arlington, but those changes only impacted apartments to be created within a single-family home, like in a garage or attic. The rule tweaks also allowed property owners to convert existing detached buildings on their lots into ADUs, but they did not allow anyone to build new ADUs unattached to other buildings on the property.

This latest proposal would change that. County staff examined the potential for one-foot, five-foot and 10-foot setback requirements, and they settled on the middle option as the best way to balance competing priorities.

“The five-foot setback balances privacy and separation concerns, design flexibility and the county’s housing goals regarding increasing housing options,” staff wrote in documents presented at an open house earlier this week.

Staff estimate that altering the setback requirements in that way would allow the owners of 42 percent of all homes in residential zoning districts to build new ADUs. They expect that a five-foot setback would allow some space between property lines and ADUs, and create enough room for direct sunlight to flow into all buildings on a given property.

Officials declined to side with a one-foot setback requirement, noting that it would allow for considerably less privacy, with buildings right up against property lines. Yet they found that it would only slightly increase the number of properties where ADUs could be built — 44 percent of residential properties would be eligible, staff estimated.

They also found that buildings so close to property lines are subject to more stringent fire safety-related building requirements, whereas buildings five feet away are not, “potentially decreasing the cost of construction for the owner.”

As for the 10-foot setback option, staff found it would substantially decrease the percentage of eligible properties — they calculated about 37 percent would qualify — while also creating the potential for buildings on sites to feel more clustered together, creating “the perception of greater massing on the site.”

It helped, too, that staff found that other, similarly sized localities around the country use the five-foot setback standard.

Staff found that Charlottesville, Seattle, Santa Cruz, California and Los Angeles County all use a similar guideline — only Portland uses the 10-foot standard, while no other localities staff examined use the one-foot setback. D.C., however, allows ADUs to be built right up to the property line, as the city has gone through its own efforts in recent years to expand access to the homes.

Staff plan to convene a series of additional meetings on the setback proposals in the coming weeks, with plans to send them to the Planning Commission for debate by May 6. The County Board could then take action by May 18.