This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: The County significantly increased the assessment value of my home this year, should I appeal it?

Answer: It’s that time of year again… time for homeowners to find out they’ll be paying more in real estate taxes this year due to an increase in the assessed value of their homes. Arlington increased the assessed value of residential real estate by an average of 4.3%, which is less than the 6.3% increase in average sold price in 2019 and much less than the 8.9% increase in median sold price.

Tax assessments are based on the sum of the County’s determination of the value of the land your home sits on and the value of the improvements made to that land (your home). The County adjusts each of these values every year to generate the total assessed value, of which Arlington homeowners pay about 1% of each year to the County in real estate taxes.

Based on conversations I’ve had with homeowners around the County, it sounds like most of the increase in assessments this year were driven by increases in the land value, which makes sense.

Assessed Value vs Market Value

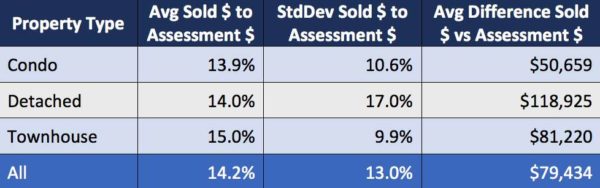

While it is frustrating to see your assessment increase so much, costing homeowners an average of a few hundred dollars in additional tax payments, it’s highly unlikely you’re in a position to challenge your assessment. Over the last 14 months, the County’s assessed value was an average of 14.2% below what homes actually sold for.

Here’s a breakdown of how the County’s assessment compared to actual sold prices since 2019, broken out by zip code, property type and price range. Here are some highlights from the data:

- If the County’s assessment matched actual market values, homeowners would pay an average of about $800 more per year in taxes

- Unsurprisingly, the zip codes with the greatest difference between market values and assessed values were all three South Arlington zip codes (22202, 22204, 22206), with homes in 22202 (home to Amazon HQ2) selling for nearly 20% more than the County’s assessment

- The County has the most difficult time assessing home values in 22205 compared to other zip codes and, unsurprisingly, detached homes compared to condos or townhouses

- Residents who own homes worth over $1M benefited the most by the County’s low assessments, with market values nearly 19% higher than their tax assessment, resulting in an average annual savings of about $1,900 if the County’s assessments were on par with market values

As reported by ARLnow last week, the County will not increase the tax rate (percentage of assessment homeowners pay in annual taxes) and may still decide to reduce the tax rate to offset increased assessments. The hope for many homeowners is that as commercial vacancy rates drop from the historic highs over the past decade, the increased tax revenue from businesses will allow the County to ease the tax burden on homeowners by reducing the residential real estate tax rate.

As always, if you are considering buying, selling, or investing in Arlington/Northern Virginia real estate, feel free to email me at [email protected] if you’d like to discuss your strategy and/or current market trends.

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local real estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington D.C., and Maryland with RLAH Real Estate, 4040 N. Fairfax Dr. #10C Arlington, VA 22203, (703) 390-9460.

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Second, it’s better for you and your family. Fragrant chemicals in surface cleaners can expose you to a similar amount of pollutant particles as a busy city road, New Scientist reported.

Northern Virginia Family Practice (NVFP), known for its comprehensive concierge healthcare, is thrilled to introduce Mark Sullivan, MD as the newest member of its family medicine team.

Dr. Sullivan brings a wealth of experience in family medicine, underpinned by a passion for delivering personalized, patient-centered care. He has a distinguished background in managing various medical conditions, emphasizing preventive care, health education and chronic disease management. Dr. Sullivan is adept at employing the latest medical research and technologies to enhance patient outcomes.

Beyond his medical expertise, Dr. Sullivan is committed to the well-being of his community, demonstrating this through his active engagement in local health initiatives and educational programs. His approach to medicine is holistic, focusing on integrating physical, mental and emotional health and patient education to achieve optimal patient wellness.

Dr. Sullivan is now accepting new patients at their newly established Arlington office at 2445 Army Navy Drive, Arlington, VA, 22206. The office, known for its patient-friendly amenities and state-of-the-art medical facilities, continues to provide the exceptional, personalized care NVFP is known for in its newly upgraded Arlington location.

Fascination

Goth-Dark Wave Dance Party with Belly Dancing and Drag King Show.

Part of OurAlternative Thursdays for Alternave People with Alternative Lifestyles

Performances By

Belladonna and the Nightshades

Ya Meena

Drag King - Ken Vegas

DJ Michelle Guided

National Chamber Ensemble – Concerto Celebration

We invite you to join us for an extraordinary evening of music at our Season Finale, “Concerto Celebration”! Enjoy several masterworks as NCE performs two famous concertos in an intimate chamber music setting, opening with a delightful work by Chevalier