(Updated at 5:10 p.m.) Clarendon-based Axios is now officially part of Atlanta-based cable operator and media conglomerate Cox Enterprises.

The $525 million sale of the five-year-old, newsletter-centric online news company — a seismic event in the media industry — closed on Sept. 1, according to Axios’ Dan Primack, less than a month after it was first announced.

The company grew rapidly after its January 2017 founding by Jim VandeHei, Mike Allen and Roy Schwartz, former stars of Rosslyn-based Politico, which itself was recently acquired.

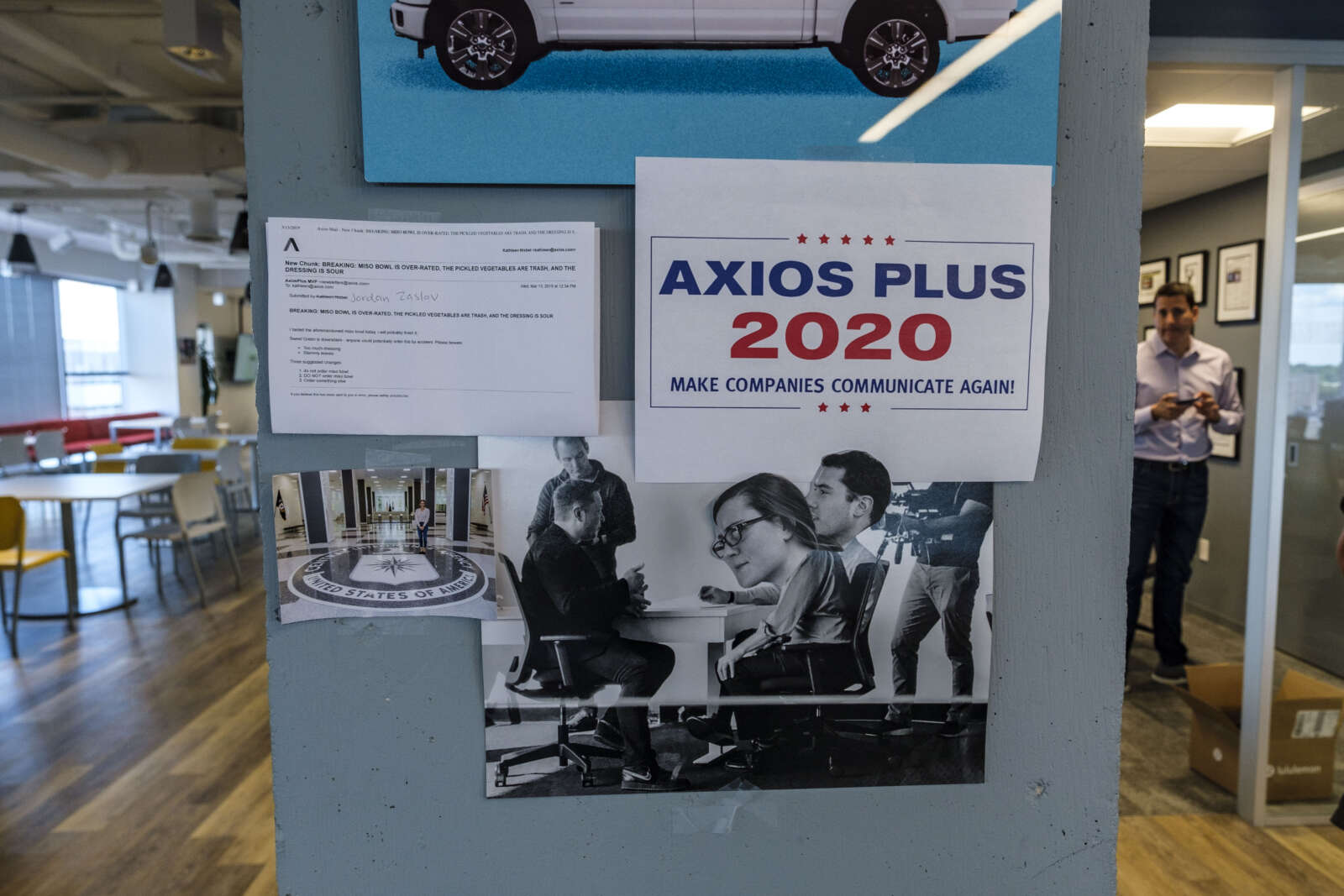

Just a year after its launch Axios graduated from a co-working space on a lower floor of 3100 Clarendon Blvd to snazzy new digs on a top floor. In 2020, after establishing itself as a prolific publisher of scoops in the worlds of U.S. politics, dealmaking, media and other topics, it set its sight on an unlikely expansion opportunity: local news.

Axios acquired the local news website Charlotte Agenda in December 2020 for a reported $5 million, rebranding it Axios Charlotte and enlisting its co-founder, Ted Williams, to help lead the rapid expansion of Axios Local.

Not even two years later, Axios Local now has 24 local newsletters across the country, operated by two-to-three person local teams that do a mix of original reporting and curation of other local news sources. The Axios D.C. newsletter launched about a year ago.

Local news, of course, is a difficult business. Newspapers are in rapid decline, with revenue down 60% and overall employment down 70% since the mid-2000s. TV stations, which generate much of their revenue from local news, may be at or near a peak before revenue starts to decline. Cox sold a majority stake in its TV station group to a private equity company in late 2019 and sold off stations in 12 markets earlier this year.

Axios is among a newer generation of online-only local news publishers that have not yet matched the journalistic firepower of local newspapers in their pre-internet heyday, when the printed paper was the go-to route into the homes for local advertisers, from department store inserts to “help wanted” classifieds.

Google, Facebook, Craigslist, Angie’s List, Yelp and any number of other online resources have since given advertisers more ways to reach local consumers, leading to a decades-long bleeding of revenue away from local newspapers and what had been their distribution-based monopoly on customer attention.

Into the breach have stepped Axios and its fast-growing local newsletter competitor 6AM City, as well as earlier local-news-at-scale efforts like Patch and more localized, independent online-only publications like ARLnow (plus sister sites ALXnow and FFXnow).

There are currently more than 700 independent local news startups in the U.S. and Canada, according to Local Independent Online News Publishers, a trade group that ARLnow helped to found. While a handful of online news ventures have grown to rival the size of local newspapers — the nonprofit Texas Tribune has more than 50 journalists — none so far have achieved anything approaching nationwide ubiquity.

Axios is seeking to be the first.

“Our goal of 100 cities is in reach,” Axios Local publisher Nick Johnston told Poynter’s Rick Edmonds in August. “I have a list of 384 metropolitan areas in my office, and we cross them off one by one.”

It was those kind of grand local ambitions that drew the 124-year-old, privately-held Cox Enterprises — which dates back to 1898, when its founder purchased the Dayton Daily News in Ohio — to Axios.

From CNBC:

The company ramped up talks to buy Axios several months ago, intrigued by the company’s push into local journalism, VandeHei said in an interview. […]

While some current investors weren’t interested in adding more capital, Cox felt confident in the leadership’s ability to monetize local journalism at scale with a lean digital-first approach, said Cox Enterprises Chief Financial Officer Dallas Clement in an interview.

“Cox became an investor in Axios last year and has a lengthy history of supporting local news,” Axios spokesperson Lauren Shiplett told ARLnow last month. “Cox’s leadership has publicly expressed its excitement about Axios Local’s rapid growth as well as the strength of our national platform.”

While Axios has received some criticism for its aforementioned lean approach to local news — the company has roughly the same number of journalists covering each metropolitan area as ARLnow, ALXnow and FFXnow each employ for individual suburban submarkets of Northern Virginia — it has allowed it to expand without breaking the bank.

But that doesn’t mean the overall Axios Local operation is profitable.

“Axios Local has front-loaded its investment to focus on growth,” Shiplett said. “In 2021, Axios Local generated $5M and is projected to reach $10M in revenue in 2022. ”

By comparison, Charlotte Agenda alone generated $2.2 million in revenue in 2019, prior to its acquisition by Axios, the New York Times reported. It was solidly profitable, with 30% profit margins.

For now, the focus is on growth — and that includes growth in the local effort’s workforce.

“Roughly 100 employees work on Axios Local,” said Shiplett. “While the exact breakdown continues to evolve as Axios Local expands, it has made several key hires for its business and leadership teams in 2022 including The Washington Post’s Jacquelyn Cameron as senior vice president of client partnerships and subscriptions and The New York Times’ Jamie Sockwell as executive editor.”

Williams, who remains based in Charlotte — the Axios workforce is mostly remote, though some, including the founders, still work from the Clarendon HQ — said the keys to the company’s success are hiring well, keeping things simple by focusing primarily on newsletters, and leveraging Axios’ national reach.

“The first key is to hire super talented journalists in each in each market,” he said in an interview with ARLnow. “Talent plays a really big, big role. Because what we’re doing isn’t it’s not a there’s no technology advantage, you know, we’re we’re sending a newsletter. And we’re running relatively simple sites. And so it really comes down to to talent.”

Axios has been able to scale the subscription base quickly, in part, by encouraging current subscribers of the national newsletters to also subscribe to their local Axios newsletter. The number of subscribers to national newsletters in each city has informed where it targets new local newsletters.

Once launched with an existing base of subscribers, the newsletters continue to grow thanks to a combination of word of mouth and paid advertising.

“People love the newsletters, they’ve all grown quickly,” Williams said.

And even brand new local publications start out generating revenue, thanks to Axios’ national reach.

“Axios has a lot of relationships with advertisers that see the value and newsletter advertising,” Williams said. “So it’s been straightforward to have national buyers that have interests in reaching smart professionals and local markets barely understand the format, they get newsletter advertising.”

The encouraging rise in subscribers and revenue has fueled the drive to continue to expand. Meanwhile, only needing to pay two or three people per site — made possible by the efficient newsletter format and aggregation of other local news sources — has taken some of the risk out of the equation, compared to local sites that launch with larger newsrooms.

“It’s just a mix of our expense structure is lower and we’re focused on being newsletter first for now,” Williams said. “And we’ve had national and local advertisers interested which is why [we are] accelerating and launching more and more cities.”

Williams said the performance of each local newsletter is “lumpy,” with more subscribers not always equating to more revenue, but the overall performance of Axios Local is being prioritized over worrying too much about metrics for each individual site.

“We very much view it as a portfolio strategy, rather than [thinking that] each individual city needs to be hitting X in revenue by X date.”

Williams called the acquisition “very fulfilling” and said being owned by a privately-held company like Cox “provides us with ability to think in 3, 5, 10, 100 year chunks rather than quarter by quarter basis.”

“It allows us to build the right foundation, do things the right way, not take shortcuts,” he said.

The focus is launching in more cities for now, but down the road it could transition to more of a focus on growing the existing presence in each city. Williams, meanwhile, is watching with interest what happens elsewhere in the world of local news.

“The next five years will be fascinating to see how it plays out,” he said, adding that he “would love to see Axios Local as a supporter and convener that supports” independent local news publications.

Despite the acquisition, there’s no indication of any plan for Axios to move to Cox’s home base. The three co-founders originally chose the Clarendon office location due to its proximity to their homes in Arlington and Alexandria.

Atlanta business news site SaportaReport quoted a Cox spokesperson as saying Axios “will continue to operate independently.”