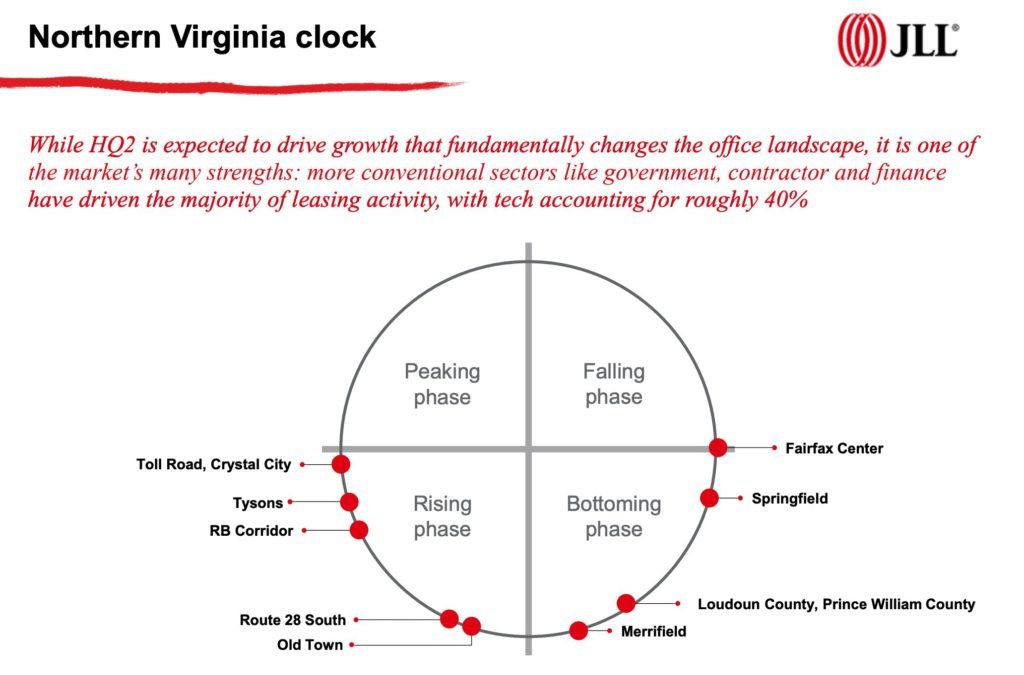

Driven in part by Amazon’s HQ2, demand for office space in Arlington is on the rise.

That’s according to a new quarterly Northern Virginia market report from commercial real estate services firm JLL, which says “tech demand across the Herndon-to-Crystal City corridor” is leading to more office space being leased than is being built.

Here are some key takeaways and quotes from that report:

1. Metro ridership may be dropping, but office tenants still want to be near a Metro station

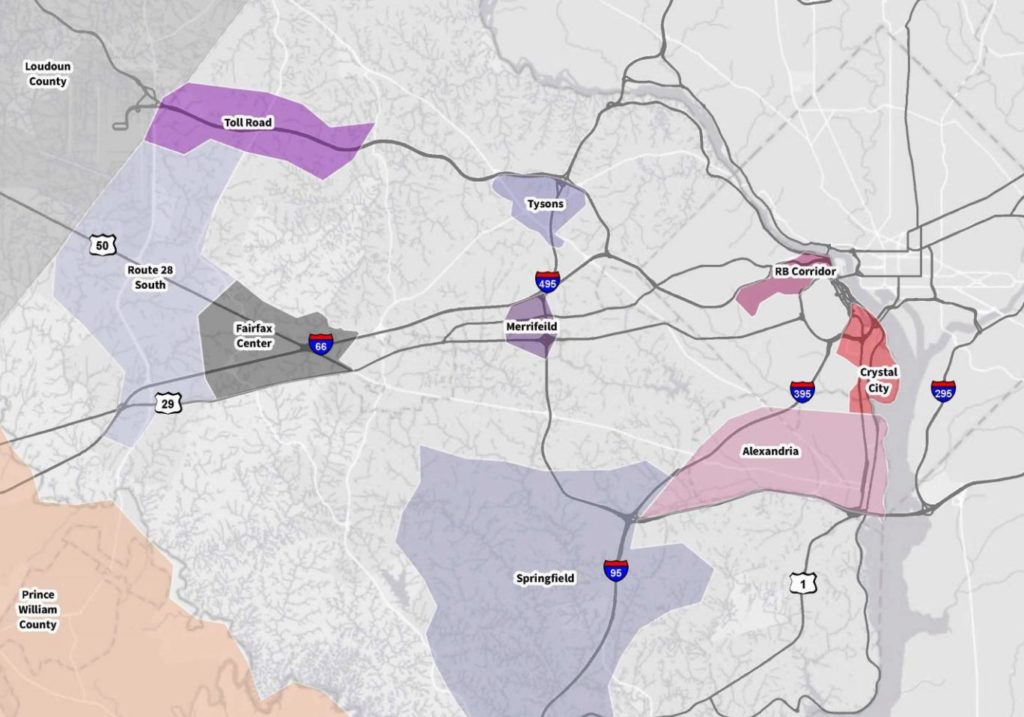

The Silver Line corridor, from the RB Corridor through Tysons to the Toll Road, continues to capture a disproportionate share of leasing activity, driven by tenants favoring Metro access…

Metro access continues to drive pricing, with newer Class A product on-Metro commanding a 35% premium over newer Class A product off-Metro; Class B/C saw an overall jump in asking rents this quarter driven by increases in Crystal City.

2. Technology is driving office demand, including in Arlington, but much of the tech talent is in Fairfax and Loudoun counties

Northern Virginia dominates the region’s tech office market and will continue to grow its leadership position, with a tech corridor solidifying from Data Center-centric Loudoun County, through the Toll Road and Tysons, and into RB Corridor and Crystal City…

Driven by the origins of tech in this market, neighborhoods west of Tysons offer the most access to talent, primarily along the Toll Road and into Loudoun County.

3. The Rosslyn-Ballston corridor has higher office rents, but “National Landing” — Crystal City, Pentagon City and Potomac Yard — has a bigger office development pipeline

Tysons and the Toll Road offer the most scale for future ground-up development, holding 50% of the proposed office pipeline; meanwhile, inside the Beltway, greater Crystal City will form as a development hub for obvious reasons, while the RB Corridor’s future pipeline is minimal.

4. Expect rent increases to accelerate, as office buildings fill up following a decade of high vacancy

Submarkets continue to see minimal to no net effective rent growth versus a decade ago, driven by concessions remaining at peak levels, particularly as tenants are cross-shopping more than ever; however, we believe this trend is nearly over, particularly in Crystal City, RB Corridor and the Toll Road, due to market demand and tightening.

5. Defense contractors, a usual staple of Northern Virginia office demand, are not having as much of an impact on the market

The defense budget declined by $111 billion from 2011 to 2016, driving significant occupancy losses. However, the budget is surging again, up 16% since 2017…

Historically, when defense spending surges, absorption surges, and when it declines, occupancy declines; while this cycle is still early, it is already different. One reason – the major contractors all rightsized during the downturn and remain focused on efficiency in their space utilization.