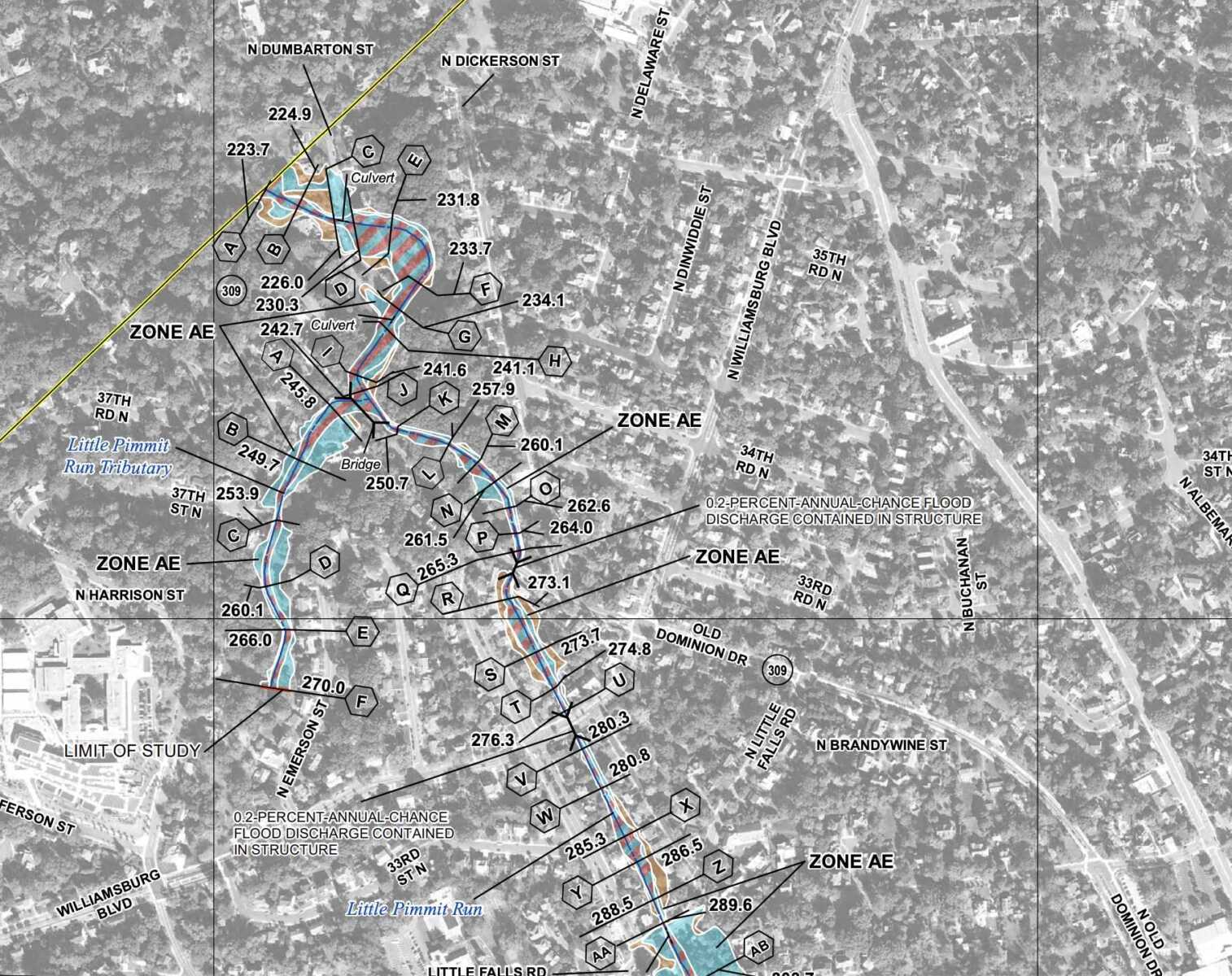

More Arlington properties could be impacted by 100- and 500-year floods, according to new federal flood insurance rate maps.

The county estimates some 300 buildings, up from 172, now risk a 1% annual chance of being inundated by floods expected to happen once a century. Another 1,150 parcels, up from 1,054, face a 0.2% annual chance of floods that come around every half-millennia.

It identified the probable increase after comparing existing and new floodplain boundaries drawn by the Federal Emergency Management Agency.

In 2020, FEMA proposed new floodplain boundaries and approved them this May, giving Arlington six months to adopt the changes or get booted from its program providing flood insurance to residents, according to a county report.

FEMA also declared emergency services, healthcare facilities and government records storage could no longer be located within 500-year floodplain boundaries, while accessory structures within 100-year floodplain boundaries have to be smaller than 600 square feet and only used for vehicle parking and storage.

Lastly, it created the option, which Arlington is taking, to require greater flood-proofing for the lowest level of structures in 100-year floodplains, also called high-hazard flooding areas. Building to these specifications helps property owners lower their flood insurance premiums, according to the county.

The impacts are “unavoidable,” per the report. The changes are slated to be adopted next month after a public hearing, which the Arlington County Board authorized over the weekend. The new maps, restrictions and building requirements go into effect Nov. 16.

Despite the increases it documented, the county emphasizes the number of affected properties is low.

Only 25% of buildings in a 500-year floodplain, or 150, are non-residential and stand to be potentially impacted by the use restrictions on emergency services, healthcare facilities and government records storage. Some 714 parcels are expected to be impacted by the restrictions on accessory structures.

The report attributes the few affected properties to a longstanding county policy to buy land in floodplains to “discourage unwise development.” Arlington prohibits construction within 15 feet of 100-year floodplain boundaries. FEMA also calls these zones special flood hazard areas and requires owners of property within them to get flood insurance.

“Overall, most parcels and structures within the County are actually not impacted by these new floodplain maps,” Stormwater Communications Manager Aileen Winquist told ARLnow. “Due to Arlington’s extremely forward thinking past policies, many flood prone properties were acquired for parkland.”

The county’s first stormwater plan, from 1957, recommended local government buy land within floodplains.

“Implementation of this recommendation was ahead of its time, and as a result, relatively few properties in Arlington are in the 100-year floodplain,” the county report says. “Instead of large-scale development in the floodplain, Arlington County has an extensive network of stream valley parks as a result of acquisition of stream valleys by the County.”

Crediting these that policy and the prohibition on new building close to flood zones, Arlington County says today, only 300 insurable structures now fall in FEMA’s new high-risk 100-year floodplain areas, comprising 0.6% of all structures in Arlington. Another 150 buildings are within 15 feet of the same boundaries.

The county contrasts itself with other jurisdictions that have relied more on flood-control infrastructure, such as levees, and disaster relief for flood victims.

“This approach did not reduce losses… and this strategy did not discourage unwise or risky development,” the report said. “In fact, it may have actually encouraged additional development in areas of high risk.”

Today (Friday) marks the last day lawmakers can file legislation to be considered in the 2022 session.

Several of the bills Arlington County legislators introduced align with County Board priorities — from making permanent electronic participation in public meetings to increasing state funding for affordable housing and including race and ethnicity on driver’s licenses.

They’ve also introduced legislation to address issues that came up in the community last year.

After residents exposed poor living conditions at the Serrano Apartments to ARLnow, Del. Alfonso Lopez (D-49) pre-filed a handful of bills aimed at strengthening tenant protections. Lopez also appears to have taken inspiration from the Advanced Towing saga with a bill that would make tow truck driver violations subject to the Virginia Consumer Protection Act.

Here’s a roundup of some other bills Arlington’s lawmakers put forward.

Policing

- Independent policing auditor: This bill, House Bill 670, would allow Arlington County to appoint an independent policing auditor who will support the law enforcement Community Oversight Board that was created out of the Police Practices Group recommendations. Del. Patrick Hope (D-47) is chief patron of the bill.

- Law-enforcement officers; conduct of investigation: HB 870, which Lopez introduced, would require an officer who was involved in a shooting to be interviewed within 24 hours of the incident.

Environmental issues

- Beverage container deposit and redemption program: HB 826, introduced by Hope, would establish a beverage container deposit, refund and redemption program involving distributors, retailers and consumers. There would be an advisory committee, required reporting and civil and criminal penalties for violations.

- Packaging Stewardship Program and Fund: The bill, HB 918, would allow the state Department of Environmental Quality to charge sellers in the commonwealth a fee for the amount of packaging their products use and if they’re easily recyclable. Those fees would be paid into a fund and used to reimburse participating localities for expenses related to recycling, invest in recycling infrastructure and education and pay the program’s administrative costs. Lopez introduced the bill.

- Parking of vehicles; electric vehicle charging spots; civil penalties: Senate Bill 278 prohibits a person from parking non-electric vehicles in electric vehicle charging spots. It sets a civil penalty between $100 and $250 with the possibility the vehicle is towed or impounded. Sen. Adam Ebbin (D-30) introduced the bill.

- Driving Decarbonization Program and Fund. This legislation, HB 351, would establish a program and a fund that would assist developers with non-utility costs associated with installation of electric vehicle charging stations. It was introduced by Del. Rip Sullivan (D-48).

Health

- Insurance; paid family leave: SB 15, introduced by Sen. Barbara Favola (D-31), would establish paid family leave as a class of insurance that would pay for the income an employee loses after the birth of a child or because the employee is caring for a child or family member.

- Hospitals; financial assistance for uninsured patient, payment plans: This bill, SB 201, requires hospitals to screen every uninsured patient, determine if they’re eligible for financial assistance under the hospital’s plan and create a payment plan. The bill also prohibits certain collection actions. Favola introduced the bill.

Rights

- Constitutional amendment; marriage; fundamental right to marry, same-sex marriage prohibition: This constitutional amendment, SJ 5, would repeal the constitutional provision defining marriage as only a union between one man and one woman as well as the related provisions that are no longer valid as a result of the U.S. Supreme Court decision in 2015. Ebbin introduced the amendment.

- Absentee voting; verification by social security or driver’s license number: SB 273, introduced by Ebbin, would make optional the current absentee ballot witness signature requirement. It would give the voter the option to provide either the last four digits of their social security number or the voter’s valid Virginia driver’s license number instead.

Title insurance is boring, but Allied Title & Escrow is here to decode the jargon and make it (somewhat) more interesting. This biweekly feature will explore the mundane (but very necessary!) world of title insurance while sharing interesting stories of two friends’ entrepreneurial careers.

When you purchase a home, it can be one of the most exciting times of your life.

With a home purchase, however, comes a lot of responsibility, and you want to protect your best investment. Therefore, you need to make sure your home stays in tip-top condition and is free of any encumbrances.

In order to do so, it’s always a wise decision to purchase both homeowners and title insurance. While both types of insurance protect your home, there are some very fundamental differences between the two types of coverage.

What is Homeowners Insurance?

Homeowners insurance is a policy that covers any damage or any type of loss to your home. It also covers damage on any other structures that are on your property, any subsequent liability, medical expense or if someone hurts themselves on your property.

Homeowners insurance can also provide coverage for any personal items and belongings inside your home or any natural disaster that might damage your property. With homeowners insurance, you can add additional coverage such as earthquake or flood insurance. However, each state is different in how they handle natural disasters and what is included in their homeowners policies.

What is Title Insurance?

Title insurance is a type of insurance that protects your ownership in the home or property. Title insurance is essentially a guarantee that you are the owner and have the true entitlement to your property. Title insurance also takes into account all of the previous owners, transfer and uses.

A title search needs to be performed to legally transfer any real estate property and helps determine if the property is free and clear of any encumbrances or defects. Title insurance is obtained at closing and will also protect you if prior taxes are still due and will insure that the deed to your property is recorded correctly.

Once the title company is sure the property does not hold any of these types of liens, the title company will issue title insurance.

There are two types of title insurance policies:

- A Lender’s Policy, which is also called a loan policy, protects the lender against any title claims or defects.

- An Owner’s Policy will protect the owner and cover the full value of the property. If you purchase the enhanced policy, it covers 150% of the value of your home after five years.

What are the Differences Between Homeowners Insurance and Title Insurance?

The difference between homeowners insurance and title insurance is that homeowners insurance protects the actual home and anything around or inside it.

Title insurance, on the other hand, is needed for the assurance that the property you just purchased is free of any debt, encumbrances and that you are and will be the owner for the future. In addition to this, title insurance is paid once whereas homeowners insurance is paid annually.

What are the Similarities Between Homeowners and Title Insurance?

The similarities between homeowners and title insurance are that some lenders will require both types of insurance and that they both offer protection. Homeowners insurance protects you so you have the resources to pay for any damage that might occur to your property.

Title insurance protects you from anyone else claiming your home is theirs or for some prior owner’s back taxes or encumbrances or any other real property dispute.

Have questions related to title insurance? Email Latane and Matt at [email protected]. Want to use Allied Title & Escrow when you buy a home? Tell your agent when you buy a house to write in Allied Title & Escrow as your settlement company!

(Updated at 12:40 p.m.) Across the country, restaurants have started suing insurance companies over their refusal to pay business interruption claims.

Many businesses have insurance policies that cover loss of income due to disasters. Restaurants say being forced to shut down by state and local governments to help slow the spread of the coronavirus is such a case and are seeking payments. Insurance companies, however, say the policies mostly cover interruptions caused by property damage, not diseases.

Here in Arlington, at least one restaurant is seeking to press its claim in court. Guajillo Mexican restaurant, at 1727 Wilson Blvd in Rosslyn, filed suit in Arlington Circuit Court against its insurance company on Tuesday.

The restaurant is suing Twin City Fire Insurance Co, which is a part of the Hartford Insurance Group. Guajillo says in the suit that its policy “explicitly covered such loss when caused by a virus, including the salaries and other expenses owed.”

“Guajillo has been in Arlington for about 20 years, and is family owned. They paid for insurance, including business interruption insurance, and expected to get coverage when their business was interrupted,” Scott Rome, an attorney with D.C.-based Veritas Law Firm, tells ARLnow.

“Restaurants operated with the understanding that they were paying for this insurance for just this type of situation, and are being denied across the board by every insurance company,” Rome said. “Here, the policy covers viruses, and yet the insurance company has made no payment yet.”

While Guajillo asserts that its policy covered diseases, the head of an insurance company association suggested otherwise, at least for most business insurance policies, in an interview on CNBC yesterday.

“Virus and bacterial related events are not covered under business interruption,” said David Sampson, president and CEO of the American Property Casualty Insurance Association.

“A pandemic specifically is not something that appeared in many policies,” Sampson said. “The reason that businesses are shut down is not because of damage to property. It’s for fear of human to human transmission of a communicable disease. That’s not a property insurance claim. Now, I’m sure that there are going to be some very enterprising plaintiff’s lawyers out there that are going to try to expand coverage. That’s what they always do. But exploiting this crisis with litigation profiteering will stop America’s recovery even before it starts.”

The Guajillo suit outlines a case that may run counter to the insurance industry’s assertions.

The Policy states that “period of restoration” “begins with the date of direct physical loss or physical damage caused by or resulting from a Covered Cause of Loss at the ‘scheduled premises’.”

The Policy explicitly provides for loss due to a virus through an endorsement: “We will pay for loss or damage by ‘fungi’, wet rot, dry rot, bacteria and virus.” […]

Twin City’s refusal of coverage breached its obligation and responsibility to provide coverage available through the Policy to Guajillo due to its covered loss of business income because its premises are unusable and uninhabitable and have lost all function, which constitutes a direct physical loss under the Policy.

Guajillo is still open for delivery and takeout, but Rome says the pandemic has greatly reduced its revenue.

“Rolando Juarez can be found in his kitchen every day, he is trying to keep all of his staff employed,” the attorney said. “This pandemic has devastated his business. The insurance coverage that he paid for could help this neighborhood family-owned business survive.”

Photo via Facebook

Title insurance is boring, but Allied Title & Escrow is here to decode the jargon and make it (somewhat) more interesting. This biweekly feature will explore the mundane (but very necessary!) world of title insurance while sharing interesting stories of two friends’ entrepreneurial careers.

This week, we wanted to share two articles that explain why title insurance is worth the cost.

Because title insurance is “optional,” many times people will try and cut costs. However, purchasing a home is one of the largest financial investments of a lifetime, so is not something you want to go without!

For Article 1: Click here

For Article 2: Click here

Have questions related to title insurance? Email Latane and Matt at [email protected]. Want to use Allied Title & Escrow when you buy a home? Tell your agent when you buy a house to write in Allied Title & Escrow as your settlement company!

Title insurance is boring, but Allied Title & Escrow is here to decode the jargon and make it (somewhat) more interesting. This biweekly feature will explore the mundane (but very necessary!) world of title insurance while sharing interesting stories of two friends’ entrepreneurial careers.

For this week’s edition of Boring Title we wanted to let all of our clients know about our new ping pong challenge!

If any of our clients have a closing in our ARLINGTON OFFICE they have the chance to play an employee from Allied Title & Escrow for $100 off their title fees.

Watch out though… we’re pretty good!

Have questions related to title insurance? Email Latane and Matt at [email protected]. Want to use Allied Title & Escrow when you buy a home? Tell your agent when you buy a house to write in Allied Title & Escrow as your settlement company!

Officials Pledge Action on Flooding — “Perhaps sensitive to growing community disenchantment over past performance in addressing heavy-rain incidents, County Board members on July 13 pledged to find ways to improve local-government efforts to address the impact of flooding. ‘We have to up our game,’ acknowledged County Board Chairman Christian Dorsey.” [InsideNova]

Residents Demand Stormwater Fixes — “Alexandra Lettow was near tears as she described the losses her family suffered in Monday’s flooding to neighbors and county officials gathered at a home in Arlington’s Waverly Hills neighborhood… It was at least the seventh time the neighborhood had flooded in 19 years.” [Washington Post]

Flood Insurance Doesn’t Cover All Losses — “They have a FEMA-backed flood insurance policy through Liberty Mutual… When the insurance adjuster came Tuesday to assess the damage she dropped a bombshell. Right there in the middle of the policy it reads, for property in a basement, coverage is limited.” [WJLA]

Arlington Man Leads Police on Chase — “At first the Expedition refused to stop for the trooper, but finally pulled off and stopped on the shoulder. A few minutes into the traffic stop, the driver of the Expedition drove off from the trooper and a pursuit was initiated westbound on I-66.” [Press Release]

Board Approved 23rd Street Tunnel Request — “After years of maintaining the little-used 23rd Street pedestrian tunnel that runs under Richmond Highway in Crystal City, Arlington will request its closure from the state.” [Arlington County]

New Renderings of Rosslyn Hotel Development — “The proposed development… would replace the Holiday Inn at 1900 N. Fort Myer Drive with a building which combines residential, hotel and conference center uses along with retail and restaurant space. A 38-story tower fronting N. Fort Myer would contain a four-star hotel with 344 rooms (compared to the previously-proposed 327), and a 25-story residential tower fronting Nash Street would deliver roughly 500 studio-to-three-bedroom units (compared to the previously-proposed 490).” [Urban Turf]

Interim Economic Development Director Named — “Arlington County Manager Mark Schwartz has named Alex Iams interim director of Arlington Economic Development. Iams currently serves as assistant director of the department. He succeeds Victor Hoskins, who has served as director since January 2015.” [Arlington County]

Hoskins: Arlington in Good Shape — “Hoskins said that Arlington County has ‘nothing to worry about’ with Amazon coming in, adding that the move to Fairfax County is coming at the right time — ‘Yes, I’m done in Arlington.'” [Tysons Reporter]

Photo courtesy Craig Fingar

County Auditor Probes Police Overtime — “A performance audit conducted by the County Auditor as part of his Fiscal Year 2018 work plan found that the Arlington County Police Department’s overtime costs exceeded budgeted expenses in Fiscal Years 2016, 2017 and 2018. The audit did not identify any evidence of improper overtime.” [Arlington County]

Few Fireworks in School Board Race — “A relatively low-key race for the Democratic endorsement leading into November’s School Board race is headed to three days of caucus voting, with the two candidates focused more on the issues than landing body blows on each other. ‘I would prefer to talk about how we are going to move in a positive direction in the future,’ challenger David Priddy said when asked to lay out the biggest failures of the School Board during the period incumbent Reid Goldstein has served on it.” [InsideNova]

ACPD and Mental Health Awareness Month — “In 2018, the Arlington County Police Department responded to 2,227 calls for service involving individuals in mental health crisis — a figure that has risen each year since 2015. To increase awareness about Department initiatives and resources, we are sharing information about how we interact with the public, and how we are ensuring that our officers have the resources they need to continue to provide professional police services to our community.” [Arlington County]

School Board Member Endorses Tafti — Arlington School Board member Monique O’Grady has endorsed Commonwealth’s Attorney challenge Parisa Dehghani-Tafti in her race against incumbent Theo Stamos. [Facebook]

Launch of ‘Housing Arlington’ — “Go bigger. Be bolder. We’ve heard from Arlingtonians that housing affordability — rental & ownership — demands even more aggressive solutions. So we’re launching ‘Housing Arlington’ tonight to tackle the challenge — together.” [Twitter]

Arlington Firm Acquires Health Insurance Company — “Arlington health system consultancy Evolent Health Inc. has reached a deal to take majority ownership of a Kentucky health insurance provider… Evolent’s stock price dipped more than 28% to $10.15 per share in Wednesday afternoon trading on the news.” [Washington Business Journal]

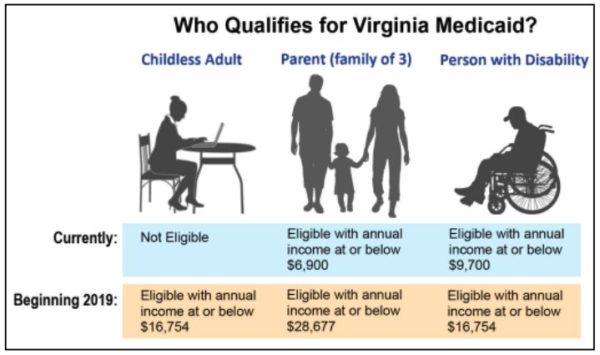

Fresh off the high of securing expanded Medicaid coverage for thousands of Arlingtonians, advocates and healthcare professionals have a new challenge to confront: how to reach people newly eligible for health insurance, when they might have no idea about the change.

That’s a big part of why state officials and Del. Patrick Hope (D-47th District) convened a meeting of more than 100 people Friday (Oct. 26) at the offices of Arlington’s Department of Human Services, offering strategies for just how they can help ensure that everyone who now qualifies for Medicaid gets covered when enrollment starts Thursday (Nov. 1).

The program’s expansion, the result of a years-long battle in the General Assembly that culminated in a compromise signed by Gov. Ralph Northam this spring, will allow low-income adults without any children to access health coverage through Medicaid for the first time ever in Virginia.

It also bumps up the income caps for families and people with disabilities, meaning that roughly 400,000 people are now eligible for the program across the state. And in Arlington alone, roughly 7,000 people could join the Medicaid rolls, according to Anita Freeman, the county’s director of human services.

“It’s a really gratifying day that we’re at this point, talking about enrolling thousands of people to get healthcare who didn’t have it before,” Hope told the crowd. “It’s a long day in coming.”

The expansion is indeed a development welcomed with jubilation by Democrats, and even some moderate Republicans, but it won’t come without complications. Not only will the process of enrolling more people in Medicaid cost localities a bit more money, but state and local officials alike have to work to make people aware they actually stand to benefit from a program that’s long shut them out.

“We’re undertaking the largest expansion of health coverage in Virginia history,” said Dr. Jennifer Lee, the director of the state’s Department of Medical Assistance Services. “We’re all super excited about it, but there is a lot of change too.”

Over the course of the meeting, Lee outlined a variety of ways that her department, which manages Medicaid in the state, plans to start reaching people about their new eligibility. That includes work with Community Service Boards, organizations in each Virginia locality focused largely on overseeing mental health and substance abuse services, and even local and regional jails.

As Lee points out, many people who are currently incarcerated have their healthcare needs covered by the state, but could be shifted to Medicaid under the new rules. And for people looking to re-enter their communities, particularly after being convicted on drug charges, she wants to connect them to Medicaid to get them the tools they need to confront their substance abuse issues.

“We want to get them in to recovery, so that they aren’t constantly cycling in and out of the system due to their addiction,” Lee said.

State officials will also launch a series of mailers to people receiving other government benefits, like food stamps, who may be able to easily enroll in Medicaid coverage by providing a few more details to officials.

But Lee also implored attendees, many of whom came from nonprofits and other groups working with low-income people around the county, to help become “spokespeople” about the new Medicaid realities in their own neighborhoods. She’s particularly interested in finding people who can reach non-English speakers, as they might have the hardest time understanding the maze of new rules governing the program.

“The best message for folks is that the rules have changed in Virginia Medicaid,” Lee said. “If they’ve applied before, they should try again.”

Complicating matters further for Lee and her fellow healthcare advocates is that the rules surrounding the Medicaid expansion will change sometime in the future. That’s because the program will eventually require enrollees to prove that they’re employed, in school or pursuing a job in order to receive coverage, a stipulation insisted on by some state Republicans initially hesitant to back Medicaid expansion.

Yet Lee explained that the state will need to get federal approval before putting those requirements in place. She said her department will submit an application to kick off the process as soon as this week, but there’s no telling when the state will earn the green light.

“It could be next week, six months or two years,” Lee told ARLnow in an interview after the meeting. “And then there will be some ramp-up time once we get the approval, because these are complicated new rules we’ll have to put in place.”

Some Republicans have grumbled that Northam’s administration is taking too long to implement the new work requirements, and that they’ll likely contain too many “loopholes” to help people avoid working — applicants who can prove they have an illness or condition that prevents them from holding a job will be able to earn exemptions from the requirements.

But Lee believes the state’s work requirements are “right in line” with other recently adopted standards, like those in Kentucky and Indiana. She also vigorously disputes any implication that the state is dragging its feet in setting up the new requirements, noting that it’s pressing for federal approval just as quickly as it can.

“Indiana planned for years to put theirs in place,” Lee said. “When you look at other states, we’re actually pursuing an extremely aggressive timeline here.”

Yet, beyond all the complications and the political squabbling, Lee worked to stress just how valuable the Medicaid expansion will be for vulnerable Virginians.

She once worked as a physician in the emergency room at the Virginia Hospital Center in Arlington, and told a story of encountering a woman who suffered an acute stroke and wasn’t able to walk, but initially declined to be admitted to the hospital because she was uninsured and feared she couldn’t afford treatment.

“She told us, ‘I can’t be admitted because I have to go to work tomorrow,” Lee said. “So don’t forget, this is real. This is for our friends, our family, who desperately need access to care, and can’t get it.”

Arlington officials expect as many as 3,000 more people will be able to earn health insurance through the Medicaid expansion passed by state lawmakers this year — and now the county needs new staffers to sort through the paperwork.

The County Board could soon accept just over $277,000 in state funds to hire six new workers to process Medicaid eligibility applications, anticipating that Arlington will see up to 7,000 requests for coverage through the program when changes officially take effect next year.

The General Assembly approved the expansion this spring, after Democrats’ sweeping gains in the legislature set the stage for a compromise on an issue that had long roiled state politics. Now, Arlington and other localities around the state are preparing for an influx of applications from low-income and disabled workers looking to earn healthcare coverage under the program for the first time.

Starting Jan. 1, 2019, Medicaid benefits will be available for childless, able-bodied adults for the first time, so long as they earn no more than $16,754 a year. The income cap will be raised to the same level for adults with disabilities, up from $9,700 a year, while income limits will also be bumped up for families with anywhere from three to eight children.

Under those new standards, county officials project at least 2,904 additional people in Arlington will be eligible for the program, and staff fully expects that evaluating the incoming flow of applications will overwhelm county workers.

While income is one measure Medicaid officials will examine in determining if someone is eligible for benefits, the program will also require many recipients to hold down a job — Republicans insisted on including the work requirements as a condition for approving the plan, though it will likely entail complex reporting requirements.

Accordingly, hiring six new staffers would help the county better distribute work among its employees and “contribute to reducing the error rate and processing time for application and recertification processing,” staff wrote in a report prepared for the Board.

In all, the county expects to spend about $527,000 annually to afford those staffers moving forward, with the state covering just over half that amount. Staff are hoping to pay for the remaining $249,000 or so with its own money, then evaluate in future budget years if the county needs to maintain those positions.

The Board is set to sign off on the new hires at its meeting Saturday (Sept. 22).

Photo via Arlington County

Sen. Tim Kaine (D-Va.) is calling the bipartisan budget deal, which passed early Friday morning after a five-hour government shutdown, “good for the country and good for Virginia.”

The deal, which adds billions of dollars in federal spending for military, disaster relief, and domestic programs, comes weeks after a historic package of tax cuts championed by President Trump and the GOP was signed into law.

Kaine is touting several portions of the spending bill as Virginian victories, such as the $3 billion for 2018 and 2019, respectively, that the budget sets aside to tackle the national substance abuse epidemic. The Children’s Health Insurance Program (CHIP) has been funded for an additional four years, which a press release from the Senator’s office states will benefit 66,000 Virginian children.

A two year funding extension of federally-qualified community healthy centers was included in the spending bill. The Senator’s press release states that “approximately 300,000 Virginians receive health care at more than 100 community health center locations in underserved communities” across the state.

“I am proud to have worked with a bipartisan group of my colleagues last month on negotiations to reopen the government that led us toward this deal, but our work isn’t done. We now must build on this bipartisan progress and immediately proceed to debate and pass legislation that permanently protects Dreamers,” stated a press release quoting Kaine.

The bill ends military sequestration, which Kaine says has been “painful” to Virginia’s military community. It also increases national security and military spending by $80 billion in 2018 and $85 billion in 2019. Domestic spending will be increased by $63 billion in 2018 and $68 billion in 2019, which will fund education, health, and non-defense national security programs.

Other Virginia “wins” cited by Kaine, via press release, include:

- Veterans – $2 billion for FY 18 and $2 billion for FY 19 to reduce the VA health care maintenance backlog

- Child Care – $2.9 billion for FY 18 and $2.9 billion for FY 19 for child care, including for the Child Care Development Block Grant program;

- Higher Education – $2 billion for FY 18 and $2 billion for FY 19 for programs that aid college completion and affordability, including those that help police officers, teachers, and firefighters;

Drug Addiction and Mental Health – $3 billion for FY18 and $3 billion for FY19 to combat the substance abuse epidemic;- Infrastructure: Transportation, Clean Water and Broadband – $10 billion for FY 18 and $10 billion for FY 19 to invest in infrastructure, including programs related to rural water and wastewater, clean and safe drinking water, rural broadband, roads, rail and bridges;

Photo via Sen. Tim Kaine’s office