The average apartment in Arlington was 5 percent cheaper in 2014 than in 2013, according to the county.

The average apartment in Arlington was 5 percent cheaper in 2014 than in 2013, according to the county.

Last year, the average rent in Arlington was $1,834 per month, according to the Dept. of Community Planning, Housing and Development.

That’s a dropoff from $1,934 in 2013 and $1,999 in 2012. It’s the cheapest average apartment rent since 2011, when the price was $1,768 per month, according to county records.

The average rent has declined for two years in a row after consistent, steep increases. A decade ago, in 2005, the average rent in Arlington was $1,270 per month, and the average three-bedroom apartment cost $1,803. Today, the average three-bedroom costs $2,671.

This drop in average rent comes at the same time as soaring assessments for residential properties — the average assessment in the county went up 4.9 percent, with some areas increasing by an average of 11 percent year over year. That jump, concentrated in some of the poorest areas in the county, cost homeowners an additional $400 in tax bills this year compared to last.

The higher assessments also hit the apartment market — existing apartment assessments jumped by 4.7 percent in 2015, but it appears that price bump has not yet been passed on to apartment renters.

It’s unclear if the two-year decline in rents is a trend or a blip. Arlington’s rental vacancy rate is at 3.8 percent — its office vacancy is at 20.4 percent, by comparison — and there are currently 2,055 net new apartment units under construction in the Metro corridors, per planning staff. Some of those units — like the Central Place development in Rosslyn — won’t come online until after 2016.

Since 2000, Arlington has added more than 23,000 residential units in the Metro corridors, many of them upscale rental apartment buildings. Metro ridership continually increased over that time, until recently. From 2010 to 2014, Arlington lost several thousand weekday Metro riders in both of its Metro corridors.

So far, developers aren’t showing signs of being scared off. Arlington still projects its Rosslyn-Ballston and Jefferson Davis Highway corridors will add a combined 35,000 apartment units by 2040.

Representatives from 16 different countries will visit Arlington to learn how the county assesses properties for tax purposes.

Representatives from 16 different countries will visit Arlington to learn how the county assesses properties for tax purposes.

Arlington’s Dept. of Real Estate Assessments will be giving representatives from countries like China, India, Turkey and Greece “guidance on proper property tax management, including an overview of how Arlington County values land and property, and how these processes have generated revenue, while promoting fair and equitable property tax collection methods,” according to a press release from Thomson Reuters, which organized the meeting.

Thomson Reuters’ Tax & Accounting Division helps corporations and governments improve their bookkeeping and revenue-generating practices. Arlington boasts an enviable tax revenue split of 50 percent residential and 50 percent commercial tax revenue, and the assessor’s office is responsible for determining the value of each piece of property.

“Arlington County’s strong, successful tax management system has attracted the attention of government officials from emerging nations,” Brian Jaklitsch, a spokesman for Thomson Reuters, said in an email.

“Officials will get a first-person look at how a government in the US processes and records land rights, and how the information is then used to assign a land value and then to process and bill property tax,” according to a press release. “More than 70 percent of local government revenue in the US is generated from property tax, and generating similar revenue could be a major coup for countries that are impoverished and/or lacking proper recording channels.”

Photo via Google Maps

Arlington’s residential real estate assessments rose by 4.9 percent on average for 2015, but some of Arlington’s lowest-income neighborhoods, which can least afford the corresponding rise in property taxes, are experiencing the biggest spikes.

Arlington’s residential real estate assessments rose by 4.9 percent on average for 2015, but some of Arlington’s lowest-income neighborhoods, which can least afford the corresponding rise in property taxes, are experiencing the biggest spikes.

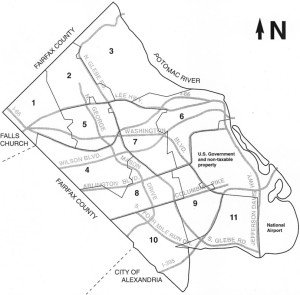

According to the trend map (left) provided by the county’s Department of Finance, the area hit hardest by the assessment rise was the southwestern-most part of the county, from Columbia Pike to the border with Alexandria (area 10).

The average assessment for this area rose 11 percent, from $362,527 to $402,404. Homes in this area were the least valuable on average in the county last year and, despite the $40,000 jump, are the least valuable this year. If the tax rate remains at around one dollar per $100 of assessed value, the owners of houses in this area will pay about $400 more on average this year than last year.

The area with the second-least valuable homes in the county is area 8, which includes the Columbia Heights West, Barcroft and Glencarlyn neighborhoods. The average assessment rose 9 percent in this area, from $388,215 to $423,115, or an average increase of about $350 in property taxes this year over last.

By contrast, the wealthiest area in Arlington — area 3 in the northernmost part of the county — experienced almost no rise in assessments. The average home was valued at $1,011,423 last year and $1,014,566 this year, a 0.3 percent increase.

The full list of changes, with area numbers corresponding to the above map:

- Area 1: $713,202 in 2014; $748,523 in 2015; 5.1 percent increase

- Area 2: $810,380 in 2014; $853,100 in 2015; 5.3 percent increase

- Area 3: $1,011,423 in 2014; $1,014,566 in 2015; 0.3 percent increase

- Area 4: $646,590 in 2014; $683,000 in 2015; 5.6 percent increase

- Area 5: $698,305 in 2014; $710,175 in 2015; 1.7 percent increase

- Area 6: $514,552 in 2014; $551,594 in 2015; 7.2 percent increase

- Area 7: $554,480 in 2014; $598,880 in 2015; 8.0 percent increase

- Area 8: $388,215 in 2014; $423,115 in 2015; 9.0 percent increase

- Area 9: $410,274 in 2014; $438,993 in 2015; 7.0 percent increase

- Area 10: $362,527 in 2014; $402,404 in 2015; 11.0 percent increase

- Area 11: $524,082 in 2014; $553,954 in 2015; 5.7 percent increase

Residential real estate assessments for 2015 have risen 4.9 percent, Arlington County announced Friday morning.

Residential real estate assessments for 2015 have risen 4.9 percent, Arlington County announced Friday morning.

Assessments county-wide rose 3.4 percent over 2014 values. The 4.9 percent rise in residential values (including condos, townhouses and single-family homes) was paired with a 4.7 percent rise in the assessments of existing apartment buildings.

Dragging down both was a 4.5 percent decline in existing office property assessments. Arlington County has been struggling with an office vacancy rate north of 20 percent.

“Arlington’s overall real estate market remains resilient,” Arlington County Manager Barbara Donnellan said in a statement. “The strength of our residential market balances the tremendous pressures we see in the office building market due to the effects of BRAC and regional competition.”

Real estate assessments are being mailed to all Arlington property owners today. The 2015 assessments will also be posted online and made available at 11:00 tonight.

Unless the Arlington County Board decides to lower the property tax rate, the rise in assessments will mean higher tax bills for homeowners. Either way, it should mean lower tax bills for commercial office building owners. Despite the rise in assessments, the county is still facing a multi-million dollar budget gap for its FY 2016 budget.

The full press release from Arlington County, after the jump.

File photo

Civ Fed: Start Over on ‘Public Land’ Process — The Arlington Civic Federation voted last night for a resolution calling on Arlington County to restart its “Public Land for Public Good” affordable housing initiative. The compromise measure called for a more robust community process to discuss the idea of using publicly-owned land to build affordable housing facilities. The county’s Long Range Planning Committee has made a similar recommendation, as we reported yesterday. [InsideNova]

Stagnant Assessments Poses Challenge — Stagnant real estate assessments are causing problems for local governments around the D.C. region. In Fairfax County, it’s contributing to a $173 million budget gap. Arlington has fared better, thanks to its location adjacent to the District and the higher proportion of commercial real estate in the county (commercial property owners pay about half of all county taxes). Still, the poor state of the regional office market means that localities can’t rely on a rise in commercial property taxes to bail out homeowners. The choice for local governments, says a George Mason University study, is now to raise taxes on homeowners, cut spending or both. [Washington Post]

GW Parkway Reopens After Sinkhole Repairs — The southbound lanes of the GW Parkway reopened early this morning after repairs were made to a large sinkhole that formed between Spout Run and Route 123.

Property Assessments Expected to Rise — Arlington property owners may be on the hook for $330 to $440 in additional taxes next year, if rates stay the same. That’s because initial estimates suggest that assessments of single-family homes and condos in Arlington County will rise 8 percent and 5 percent, respectively. [Washington Post]

New Construction Coming to DCA — Reagan National Airport will be getting a new regional jet concourse, a new parking garage and larger security screening areas, as part of a just-approved $1 billion capital construction program. Security screening will be relocated to the ticketing level, which will open up the “National Hall” shopping and dining area to all security-screened passengers. The airport served 20.4 million passengers in 2013, a figure that’s expected to rise to 22 million soon. [MWAA, Greater Greater Washington]

County to Receive Breastfeeding Program Grant — Arlington County is set to receive a nearly $30,000 grant from the Virginia Department of Health to support a breastfeeding counselor program for lower-income residents. [Arlington County]

APS Thanks Voters for School Bond — The Arlington School Board is thanking Arlington voters for approving this year’s $105.78 million school bond. Among the six projects to receive bond funding are $50 million for either a new elementary school or two elementary school additions, $29 million for an addition and renovation to Abingdon Elementary, and $5 million for improvements at Washington-Lee High School that will add 300 seats. [Arlington Public Schools]

Cold, Snowy Winter Outlook — This winter is expected to be colder and snowier than usual, according to forecasters. [Capital Weather Gang]

Flickr pool photo by Kevin Wolf

Officials are still reviewing dozens of sky-high commercial real estate assessments, County Manager Barbara Donnellan told the Arlington County Board over the weekend.

Officials are still reviewing dozens of sky-high commercial real estate assessments, County Manager Barbara Donnellan told the Arlington County Board over the weekend.

ARLnow.com first reported in Februrary that numerous businesses in the Clarendon area — mostly bars and restaurants — saw their real estate assessments skyrocket this year, in one case nearly 200 percent. A week later, the county announced that it would review “all commercial real property assessments with a 50 percent or greater increase from calendar year 2013.”

That review is continuing, with Donnellan telling the Board that she had “no projection as to when it would be completed.” In an earlier interview with ARLnow.com, Rick Melman, Arlington’s director of real estate assessment, said he expected the review to wrap up by the end of May.

In all, 64 commercial properties had 50 percent or higher assessment increases and are being reviewed, Melman said. Responding to a request from ARLnow.com, the county released a list of those properties — albeit in the form of Real Property Codes, not addresses. Those codes can be searched here.

For some of the properties on the list, the big jump in assessments can be explained by building projects or development plans that drove up the value. Others remain unexplained — for instance, Rien Tong Restaurant’s nearly 200 percent increase, when neighboring restaurant Kabob Bazaar only increased 32 percent. Or Revolution Cycles’ 64 percent increase, when the Whole Foods across the street saw no increase.

Outside of Clarendon, some properties on the list stood out.

The Dolley Madison Towers apartment complex at 2300 24th Road S. saw its assessment spike from $44 million to $103 million between 2013 and 2014. The aging retail strip at 927 S. Walter Reed Drive rose in value from $1.3 million to $2.2 million. And the assessment for Ballston Animal Hospital at 5232 Wilson Blvd rose from $543,000 to $1 million.

“The assessment office is right now in the process of looking through these 64 properties,” said Melman. “It’s quite a lot to look at. At this early stage it looks that about half of them are explained by new construction, site plans, things like that. Examiners are re-examining the other half. There’s no real trend, they’re all over the county.”

Melman said the real estate assessment office, on balance, had a “pretty low appeal rate” this year. Still, he encouraged anyone who feels their property’s assessment was too high to contact the office and/or file an appeal. Today (Tuesday) is the final day to appeal to Arlington’s Board of Equalization.

“There have been some human errors on our part… and that’s what the appeals process is for,” Melman said. “We’d be glad to talk to any property owner if they have questions or concerns. Our goal is to be fair and equitable to citizen.”

Peter’s Take is a weekly opinion column. The views and opinions expressed in this column are those of the author and do not necessarily reflect the views of ARLnow.com.

That’s the key question after ARLnow.com broke the story last week about Arlington’s skyrocketing commercial property assessments.

Fair market value can rise or fall from year to year, but as Ellis Schaeffer commented last week:

[H]ow do you explain an average of [a] 65.8% increase on the 11 business survey provided in the article? Is it merely a change in methodology? Did I miss the singular event in the past 365 days (i.e., mineral deposits, or a new casino) that made Clarendon properties suddenly SIGNIFICANTLY more valuable?

In one fell swoop, Arlington’s commercial assessment fiasco has cast a dark cloud over all of the following:

- the new initiatives for economic competitiveness touted in the County Board Chair’s New Year’s Day speech,

- the integrity of Arlington’s commercial property assessment process (is it properly insulated from politics?), and

- the reliability of the revenue forecasts in Arlington’s FY 2015 budget (which depend upon the validity of the valuation of Arlington’s commercial real estate).

In the wake of this ARLnow.com bombshell, these are the elements of the public statement that the County Board should have issued:

We

- are alarmed by the enormous annual increases in so many commercial property assessments,

- are determined to get to the bottom of this, and

- have directed the County Manager to analyze and share with the public relevant information about each of these categories of commercial property:

- all properties assessed at a value 50 percent or more than last year,

- all properties assessed at a value that is between 40 percent and 49 percent more, and between 30 percent and 39 percent more, than last year, and

- all properties which experienced value increases in those same three percentage brackets (30 to 39, 40 to 49, and 50 or more), for each of the prior two years (from FY 2012 to FY 2013, and from FY 2013 to FY 2014).

ARLnow.com profiled 11 commercial properties in Clarendon alone. But, Michelle Cowan, Arlington’s Director of Management and Finance, advised the County Board there were about 90 commercial properties County-wide that increased in value by 50 percent or more.

I find both numbers (11 and 90) to be large and disturbing. But, limiting any review only to those 90 properties — as the County Government is planning — is far too narrow an approach.

To really get to the bottom of this, and ensure transparency, we need a much broader compilation, analysis and public discussion.

The County Board should step up now, and direct the County Manager immediately to broaden the inquiry to include all of the additional categories of commercial property — noted above — that are now conspicuously missing from the announced plan.

Peter Rousselot is a former member of the Central Committee of the Democratic Party of Virginia and former chair of the Arlington County Democratic Committee.

Arlington County will review the big jump in commercial real estate assessments in Clarendon first reported by ARLnow.com last week.

Arlington County will review the big jump in commercial real estate assessments in Clarendon first reported by ARLnow.com last week.

The county said Friday evening that it will take a look at “all commercial real property assessments with a 50% or greater increase from calendar year 2013.”

There are nearly 90 such properties, including Rien Tong restaurant (3131 Wilson Blvd), which saw its assessment increase 197 percent, and Spider Kelly’s (3171 Wilson Blvd), which saw its property valuation increase 83 percent.

The assessments are updated annually and used to calculate county property taxes.

“A small number of commercial property owners did see substantially increased assessments, and this review is meant to correct any mistakes that may have been made,” said county finance director Michelle Cowan, in a press release, below.

Arlington County has begun a review of all commercial real property assessments with a 50% or greater increase from calendar year 2013, including several parcels in the Clarendon area that saw significant increases.

The review will affect fewer than 90 properties, of approximately 3,300 total commercial parcels. Both the original assessments, and the underlying data for each of the affected properties, will be re-examined to determine whether the assessment should be sustained or changed.

“A small number of commercial property owners did see substantially increased assessments, and this review is meant to correct any mistakes that may have been made,” said Dept. of Management and Finance Director Michelle Cowan. “We want to ensure fair and equitable assessments for all property owners.”

Arlington’s Real Estate Assessment office is mailing letters to property owners of all properties whose assessments increased 50% or more. Upon conclusion of the administrative review by the County, property owners will still have the ability to appeal their assessment through the Board of Equalization. It is anticipated that the County’s administrative review will take 30-45 days.

Overall, commercial assessments, which include office buildings, apartments, hotels and retail, grew 5.4 percent over CY 2013, primarily fueled by new construction and strength in apartment properties due to rising rents. The specific parcels that were questioned in the Clarendon area fall into the general commercial category class, which includes retail and other types of properties, excluding office buildings and apartments. The general commercial assessment category increased by 12.4 percent over CY 2013.

Assessments for most commercial properties are based on an income approach and evaluate how much income a property would produce if it were rented as an apartment, store, factory, etc. This approach considers operating expenses, taxes, insurance, maintenance costs, and the profits most people would expect from the rental. The net income after operational costs, plus a capitalization rate, determines the assessment value. It is not based on the profitability of a particular business; rather the assessment value is based on the rents and expenses of the property and building in which the business is located.

(Updated at 1:20 p.m.) Real estate assessments for numerous Clarendon restaurants skyrocketed this year, with little explanation as to why.

(Updated at 1:20 p.m.) Real estate assessments for numerous Clarendon restaurants skyrocketed this year, with little explanation as to why.

Long-time businesses, which have not been renovated or sold recently, saw their assessments increase by double digit or even triple digit percentages. The rise in assessments could mean the owners will be forced to pay tens of thousands in additional county taxes this year, barring a successful appeal.

The biggest increase spotted by ARLnow.com was that of Rien Tong Restaurant (3131 Wilson Blvd). The Asian eatery, located across from the Clarendon Metro station, saw its assessment jump from $559,900 to $1,667,600, a nearly 200 percent increase that would result in an extra $12,528 in taxes.

The assessment for Kabob Bazaar (3133 Wilson Blvd), directly adjacent to Rien Tong in a nearly identical storefront, also increased but not as dramatically. The restaurant’s assessment increased from $635,500 to $840,700, a 32 percent rise.

The assessment for Kabob Bazaar (3133 Wilson Blvd), directly adjacent to Rien Tong in a nearly identical storefront, also increased but not as dramatically. The restaurant’s assessment increased from $635,500 to $840,700, a 32 percent rise.

The biggest tax increase as a result of higher assessments goes to Spider Kelly’s (3171 Wilson Blvd), which saw its property valuation increase 83 percent to $5.1 million. The added tax yearly bill: $26,428.

With the exception of Revolution Cycles (2727 Wilson Blvd), which had its building assessment increase 64 percent to $3.8 million, and Azure Day Spa (2420 Wilson Blvd), which increased 55 percent to $1.9 million, the businesses impacted were primarily Clarendon restaurants.

Other big increases include Eventide (39 percent), Clarendon Ballroom (50 percent), Hard Times Cafe and Delhi Club (50 percent), Boccato Gelato (71 percent), Whitlow’s (24 percent), Faccia Luna and Boulevard Woodgrill (56 percent). By comparison, the Clarendon Whole Foods store at 2700 Wilson Blvd saw no increase in its assessment.

Several restaurant owners contacted ARLnow.com about the higher assessments.

“There’s some funny business going on here,” one said, on the condition of anonymity. “This is a money grab, pure and simple.”

Arlington County Director of Communications Diana Sun says that the businesses in question are typically assessed based on a method that takes a look at the income generated by each property. That, however, can’t fully explain the increases.

“Clearly there were some that just look like an anomaly,” she said.

Sun encouraged business owners who think their assessments this year were unjust to file an administrative appeal before the March 3 deadline. Such an appeal could result in a new inspection of the property and a lower assessment. After March 3, or after an unsatisfactory result from an administrative appeal, any appeals must be filed with the county’s Board of Equalization.

The unknowns involved in filing an appeal still have some business owners on edge.

“I have to hire a lawyer now,” one told ARLnow.com “I’m pretty pissed off about it.”

The Right Note is a weekly opinion column published on Thursdays. The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

Yesterday, Arlington County released its real estate assessments. Your tax bill is going up by roughly 5 percent unless the County Board reduces tax rates later this spring. You can look up your home’s assessment here if you want to see what it means to you.

Yesterday, Arlington County released its real estate assessments. Your tax bill is going up by roughly 5 percent unless the County Board reduces tax rates later this spring. You can look up your home’s assessment here if you want to see what it means to you.

Some may argue that the rise in assessments is good news because your home is now worth more. While true, and certainly helpful whenever you decide to sell your home, we all know that we pay these taxes while we live in our homes. So, the tax increase is effectively a tax on your income, which is one of the reasons you can deduct it from your federal tax return.

Back in November, county budget staff estimated real estate assessments would go up by 2.6 percent, leaving a $20-25 million so-called “budget gap.” They now believe that number is 5.8 percent — a dramatic increase that was clearly unexpected. County Manager Barbara Donnellan said yesterday the increase will narrow the “budget gap,” but the County still faces “pressures” for increased expenditures.

As I have previously written, the “budget gap” is essentially a myth. Every year in recent memory, Arlington County takes in excess revenue over and above the budget that is then spent, rather than returned to the taxpayers. It is spent to give the illusion that the County has spending “pressures” for the following year’s budget so that the Board can then raise our taxes again.

The bottom line is that no real spending cuts would be necessary to allow the County Board to simply hold the tax increase on homeowners to the 2.6 percent anticipated assessment increase level rather than 5.3 percent level. Unfortunately, no County Board member is likely to make that case.

This is because the pressures to spend more are the creation of County Board policies. And, the Board is planning to bring more of these pressures online by locking in huge future subsidies for both the trolley and the aquatics center. These ongoing subsidies will come out of the general fund and will be spent on these priorities rather than on roads or schools or public safety — just like they did for the Artisphere.

Not to worry, when the Board’s priorities run up against the “budget gap”, they will just raise the tax rate to pay for it. As long as Arlingtonians keep voting for people with the same priorities, the cycle will continue.

Mark Kelly is a former Arlington GOP Chairman and two-time Republican candidate for Arlington County Board.