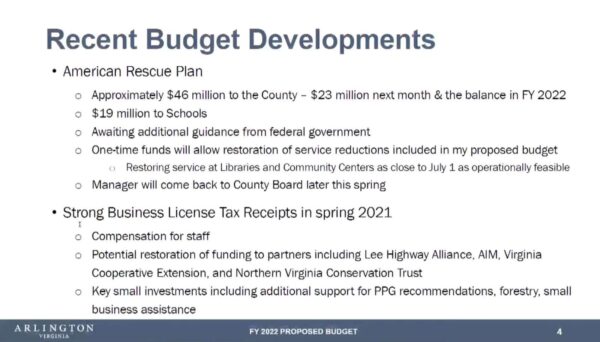

Arlington County's projected revenue appears sunnier than when County Manager Mark Schwartz first presented his proposed budget for the 2022 fiscal year in February.

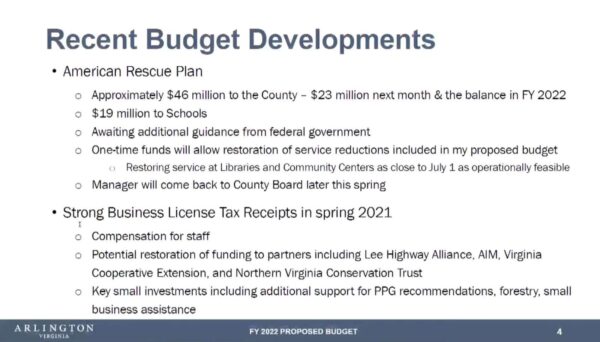

The county can attribute this warmer outlook to two sources: the nearly $2 trillion American Rescue Plan and strong business license tax receipts, Budget Director Richard Stephenson said during a public hearing on the tax rate last Thursday. While he did not specify the revenue from the business taxes, Stephenson said President Joe Biden's relief bill will apportion $46 million to the county.

Combined, the influx of cash could mean funding will be restored to libraries, community centers, Arlington Independent Media and the Virginia Cooperative Extension, for example.

Schwartz's proposed budget delays the re-opening of Cherrydale and Glencarlyn libraries and reduces support for AIM and VCE. Between 2019-20 and the proposed budget, funding for AIM had dropped by 22%, while the proposed reductions to VCE would require the organization to find new funding sources or reduce its programs. Members of the public spoke in favor of restoring funding to these programs last Tuesday.

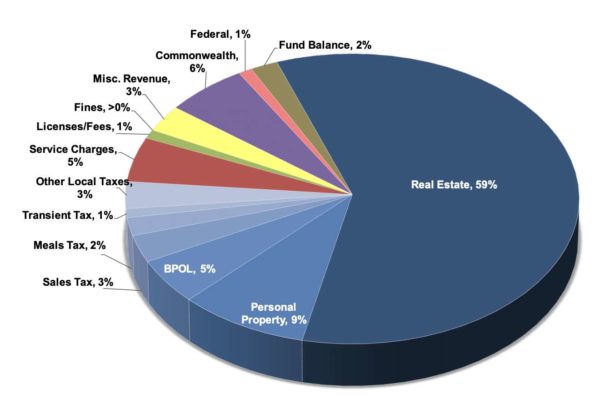

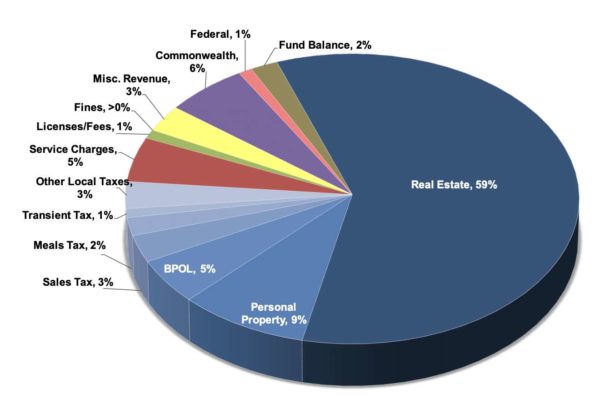

Still, Arlington County will be leaning on real estate taxes for the lion's share, 59%, of its revenue. Specifically, it will be relying on increasing residential real-estate taxes due to rising property values as commercial property assessments drop.

"We've experienced some significant reductions to several of our tax revenues and non-tax fees," Stephenson said. "We were fortunate this past January that real estate assessments came in slightly higher than we were originally projecting. While we experienced a decrease in commercial property assessments, new construction and residential properties increased."

While property values are rising, Schwartz is proposing to keep the rate flat -- at $1.013 per $100 of assessed value -- for the upcoming fiscal year. That will mean an overall tax increase for most homeowners.

The County Board is slated to vote on this rate next Tuesday.

Members cannot increase the rate but they could decrease it, which is something that a few Arlington residents told board members they would like to see.

While Arlington has proposed holding its tax rate steady, nearby jurisdictions -- including Fairfax County and Loudoun County -- have proposed lowering or approved a lower real estate tax rate, said Audrey Clement, who is running as an independent for a seat on the County Board.

"The impetus for tax reductions elsewhere is to provide relief to homeowners hit by rising assessments, even as the pandemic has put a lot of them out of work," Clement told the board.

She said the county is using falling commercial real estate tax revenue to justify freezing rather than lowering the residential tax rate.

"The county will tell you it can't afford to reduce the real estate tax rate because the pandemic has drained the commercial real estate tax revenue, but where were your real estate tax rates heading when the county was flush with revenue from corporate tenants?" she said. "They were going up."

Meanwhile, two residents, William Barratt and Cindy Nelson, both asked the County Board to reduce real estate taxes.

Barratt said the Bluemont Civic Association, of which he is a part, passed a resolution encouraging the board to reduce the tax rate. The homeowner said he and his wife have seen a 15% increase in their taxes in recent years.

"I don't think this is a wise idea for anyone: poor and rich," Nelson said. "It's just not right."

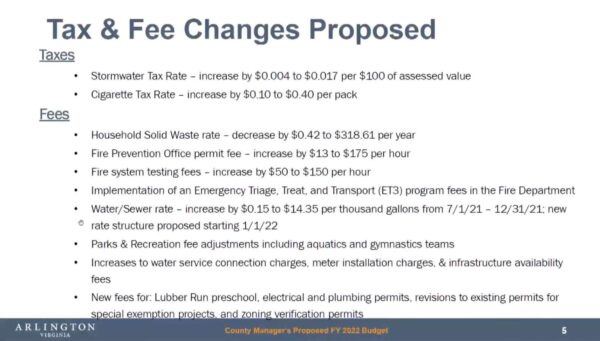

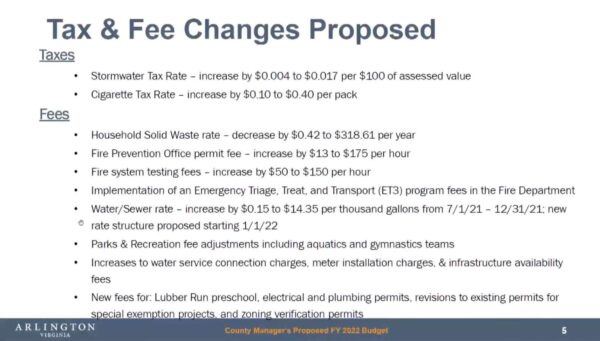

The stormwater tax rate is set to increase, which Stephenson said will help generate $15.1 million earmarked for stormwater improvements.

Eventually, the county plans to eliminate the stormwater tax completely in favor of a fee based on how much impervious surface covers a given property, Schwartz previously said.

A higher cigarette tax rate is also being proposed that could generate $600,000. Like most of the county's tax revenue, almost half of that will go toward Arlington Public Schools, Stephenson said.

Images (2-4) via Arlington County